DBJ Americas Inc.

- HOME

- Success Stories

- DBJ Americas Inc.

We want to realize our vision of managing

personal connections and knowledge as assets.

DBJ Americas Inc. is the privatized US subsidiary of the Development Bank of Japan (DBJ). This New York-based company supports the DBJ’s operations across the Americas. Since its establishment as a corporation, DBJ Americas has used Sansan for integrated management of customer and partner information.

We spoke with Mr. Shumpei Ikoma of the company’s Corporate and Structured Finance Group about how, in addition to streamlining operations, DBJ Americas is using human resources and knowledge as corporate assets. Mr. Ikoma and DBJ Americas are putting Sansan to work now and into the future.

Human networks and knowledge

are corporate assets.

Hand over, nurture, and

become a source of value.

[ Interviewee ]

Mr. Shumpei Ikoma

Corporate and Structured Finance Group

I can pull up the exact data of the places I’m visiting, so I can efficiently check this information when I’m out. This really improves productivity.

– Mr. Shumpei Ikoma

Please tell us about how DBJ Americas was established and what its business encompasses.

Mr. Ikoma: The Development Bank of Japan (DBJ) is a financial institution established during Japan’s post-war reconstruction for long-term financing of domestic infrastructure. It was privatized as a stock company in 2008 and now takes the lead in new financing methods such as the Private Finance Initiatives (a way of materializing Public-Private Partnership (PPP) and P3 projects, and financing public sector projects through the private sector), sharing its expertise with domestic financial institutions and investors. Its mission in society is to further develop the financial market.

DBJ Americas was originally the DBJ’s representative office in New York. In 2018, it was established as the fourth overseas subsidiary, following Europe (UK), Singapore, and China. It’s expected to further develop as a base for supporting the DBJ’s work across the Americas. This will be in line with the business policy of expanding overseas investment and loans, as well as its work in Japan where financial markets continue to contract.

We have a range of targets for our investments, but we have a special focus on three sectors: energy, transportation, and real estate. Specific projects we’re working on include renewable energy and other power generation, airlines and aircraft leasing companies, and real estate such as housing complexes and offices.

What sorts of results have you seen since you introduced Sansan?

Mr. Ikoma: Before joining DBJ Americas, I was in charge of financing for foreign airlines and aircraft leasing companies. Overseas business accounted for 95% of all our business, so I had many chances to go abroad for work. I attended a number of aviation industry conferences in different parts of the world. I met with people from many companies that I could invest in and made direct contact with them in future business talks.

While being in charge of all this, it was important for me to keep a record of exactly who I met and what we talked about. I met with dozens of companies each day, so this was a really tough task.

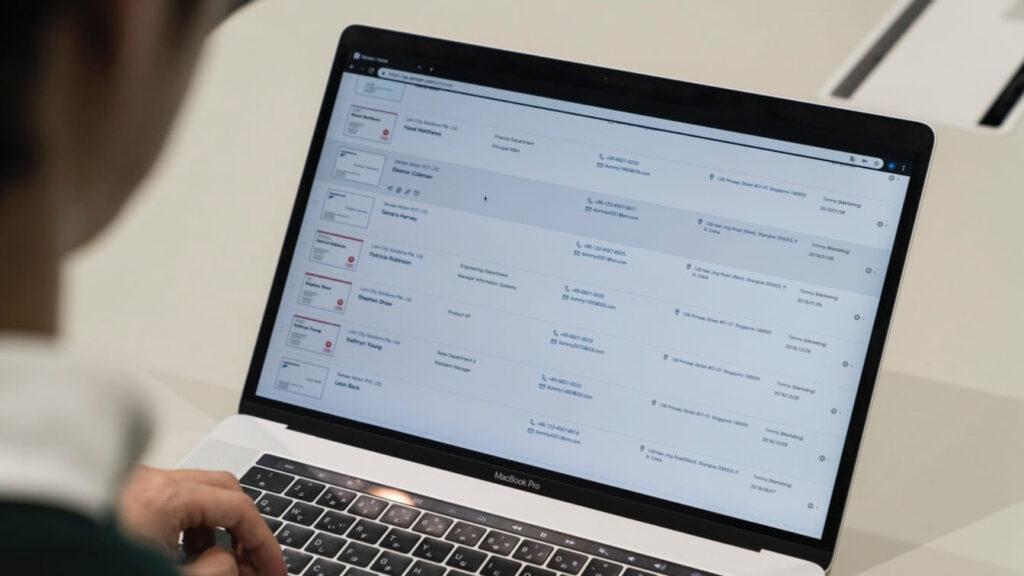

DBJ had introduced Sansan in Japan in 2016. I used Sansan, and I felt that it was extremely useful for easily recording information about contacts and deals on my smartphone and having the ability to review these records wherever I was. However, Sansan hadn’t been used in the New York office. The business cards that expat staff acquired were managed by the individual, using different methods. And there was almost no data conversion and sharing. I was then assigned to New York, and at that point Sansan had already become a powerful business tool for me. So, we explained the advantages of Sansan to the local staff and introduced it at the time we established the local corporation.

At the time you introduced Sansan, what sort of issues were you hoping to resolve?

Mr. Ikoma: Staff working at the overseas bases spend a great amount of time on business travel and aren’t in the office at their desks very often. This means there are far fewer chances to meet face-to-face and to communicate with one another in person. Despite this reality, I wanted to share the network and information that each of the staff possessed, and to create an integrated environment for cooperative work.

Job rotation within DBJ usually happens every 2–3 years. What usually occurs at those times is that personal networks and industry knowhow gained during the assignment are not taken over. We wanted to establish some sort of handover process, but this would clearly take a great deal of time and effort. We also hoped to streamline operations at the time of such transfers, and to manage personal connections and knowledge as corporate assets.

At year-end, mailing addresses for greeting cards are easily exported, which gets rid of the manual work. The office staff are really happy about that.

How are you currently using Sansan?

Mr. Ikoma: I personally have always seen the benefits of Sansan. Even in the United States, it’s very convenient that business card-based information can be read by a scanner or smartphone, converted to data, and viewed on the go. It would be difficult to write down the addresses, etc. every time I go out on business. Since I can pull up the exact data of the places I’m visiting, I can efficiently check this information when I’m out. This really improves productivity.

Do you think everyone else expected the same sorts of benefits?

Mr. Ikoma: At the time when I said we’d be introducing Sansan in DBJ Americas, I don’t think many people had any real preconceived notions about what convenience this would add. But once they got to using the system, they came to see the advantages.

A good example of this is how Sansan enables streamlined delivery of greeting cards from companies to partners and customers. It used to be that at year-end, the clerical staff would gather all the customer information from individual staff, manually check for duplicate addresses, and so on, and then print out all the addresses.

We had a party at the time we opened DBJ Americas, and we invited nearly 400 guests. Because we had Sansan in place, we were able to take all the business cards we received and digitize them so their data could be managed and shared internally. At year-end, mailing addresses for greeting cards could be easily exported, which got rid of all that manual work. The office staff were really happy about that.

Once staff got into the practice of using Sansan and managing and sharing business card information, they started experiencing conveniences like this.

Have you seen any other specific advantages?

Mr. Ikoma: For financial institutions, information leaks due to mistakenly sent mails pose a major risk. Sansan’s direct emailing function, using the data from the business card, is more effective than manually entering an email address. There’s no error from human input.

Sansan also has a function that lets you exchange messages with colleagues starting from the point of the contact/business card information. Asking one another for information about a specific contact of a customer can create a new discussion about a potential opportunity. Opportunities for collaboration are also increasing.

We’re opening up chances for communication within the company.

Opportunities for collaboration are also increasing.

How would you like to use Sansan in the future?

Mr. Ikoma: First, I’d like to realize the vision of accumulating a great deal of information within our Sansan database, and of managing personal connections and knowledge as assets. Especially when there’s a handover because someone is given a new assignment, we expect things will be greatly streamlined because we won’t need to prepare detailed documentation for the handover.

It will be increasingly important for financial institutions to look at markets and businesses in terms of both vertical connections by sector and horizontal connections across industries. We can leverage Sansan’s tagging capabilities to categorize customers and partners by sector. Accumulated information is far more valuable when we’re able to group it in this way.

DBJ’s long-term business plan states there will be activation and stabilization of financial markets through integration and collaboration. Treating customer and partner information as precious resources, along with the business created and associated with this relationship, will lead to DBJ Americas’ own increased value. Ultimately, I think that will lead to business expansion for Japanese companies and investors, and vitalization of the entire financial market.